Electric vehicles (EVs) are accelerating worldwide, but an electrifying trend gaining traction right now is battery swapping in China. This innovation goes beyond fast charging—it resets expectations of convenience, infrastructure, and the speed of transition. Here’s a deep exploration of why battery swapping in China is emerging as a potential global game-changer and how it fuels the broader adoption of EVs.

1. What Is Battery Swapping in China—and Why It’s Takeoff-Ready

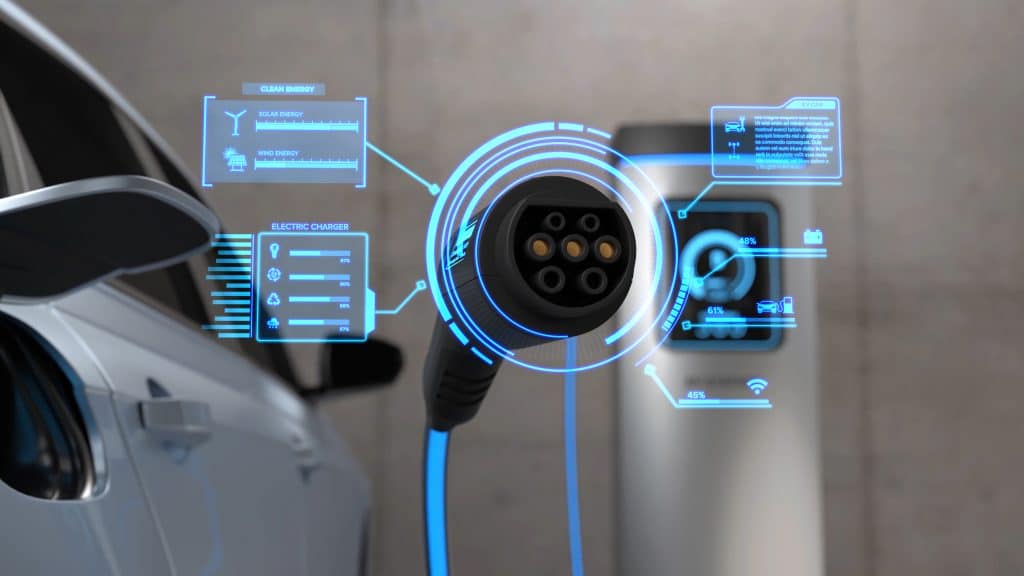

Battery swapping involves replacing a vehicle’s depleted battery with a fully charged one at a swap station—typically in under five minutes, often faster than most coffee breaks.

China’s Nio pioneered this model, now with over 3,000 automated swap stations ready to fully swap in just three minutes. Battery leader CATL has ambitious plans: 1,000 stations for passenger EVs in 2025 and a massive expansion to 10,000 by 2028—aiming to serve one million vehicles daily. They are also building 300 swap stations for heavy trucks and partnering with rental and leasing firms to launch 100,000 swappable-battery vehicles.

Government incentives in Shanghai and nationwide infrastructure policies are blending fast charging with battery swapping into China’s EV ecosystem, positioning the country as a testing ground for scalable solutions.

2. The Appeal: Speed, Accessibility, and Reduced Range Anxiety

Battery swapping delivers a trifecta of benefits:

- Lightning-fast service: Swap times of around three minutes rival gas refuels.

- No home charger needed: Ideal for urban dwellers in apartments or areas without reliable home infrastructure.

- Lower range anxiety: Drivers can top up on the go without planning long charging stops.

This combination offers a compelling alternative to both fast charging and home charging—especially in dense cities where infrastructure or access may be constrained.

3. Global EV Adoption at a Crossroads

To truly understand the impact of battery swapping in China, we must situate it within current global EV adoption trends:

- In early 2025, over four million EVs were sold globally in the first quarter—35% more than in 2024. The year is on track for 20 million new EVs sold, accounting for one in four new vehicles worldwide.

- Western Europe posted a record 600,000 battery-electric vehicle registrations in the second quarter of 2025, boosted by affordable new models and charging network expansions.

- In India’s Odisha region, EV car sales jumped 50% and scooter adoption grew 39% in the first half of 2025, thanks to subsidies and improving infrastructure.

Not all regions are accelerating:

- The U.S. EV market is slowing. Sales are expected to rise modestly from 9% in 2024 to just 10% in 2025 for EVs and plug-in hybrids.

- BloombergNEF downgraded U.S. EV forecasts by 14 million fewer sales by 2030, citing policy rollbacks such as the ending of EV tax credits under the Inflation Reduction Act.

In this landscape, battery swapping in China stands out as a speed-and-scale innovation that could bridge gaps where adoption is stalling.

4. Why China Leads—and Could Shape Global EV Infrastructure

Several factors explain why China is at the forefront:

- Scale: CATL’s projected rollout of 10,000 swap stations by 2028, serving millions of vehicles daily, sets a new global benchmark.

- Vertical integration: Major EV makers and battery giants in China control both vehicle and battery production, enabling streamlined swapping.

- Policy momentum: Strong regional incentives support both fast-charging and swapping models, ensuring consumer access.

These factors position China to leapfrog infrastructure challenges and possibly set standards that influence global EV adoption.

5. Why Other Regions Should Pay Attention

Flexibility for Urban EV Markets

Cities worldwide with limited residential charging—such as those in Europe, Southeast Asia, and parts of the U.S.—could embrace battery swapping as a scalable alternative.

Reducing Ownership Friction

Battery swapping reduces the upfront hassle: no need for expensive home chargers or long charge sessions.

Potential for Battery-as-Service (BaaS) Models

By separating vehicle and battery costs, consumers could lease battery capacity—lowering upfront purchase prices and increasing flexibility.

Resilience and Redundancy

Swapping centers diversify charging options, offering alternatives in case of grid overload or infrastructure strain.

6. What’s Holding Back Widespread Adoption?

While promising, battery swapping in China faces obstacles before going global:

- Infrastructure costs: Building swap stations is capital-intensive.

- Standardization: Vehicle batteries vary widely; universal design standards are essential.

- Complex logistics: Managing battery inventory and maintenance adds complexity.

- OEM fragmentation: Global automakers would need to align across models and regions.

7. The Future: Complementary, Not Replacement

Battery swapping will not replace charging—it complements it. As China illustrates, a dual-system approach could offer versatility:

- Home and workplace charging where feasible.

- Fast charging along highways.

- Battery swapping in urban centers or shared mobility networks.

This multi-pronged strategy addresses diverse consumer needs and infrastructure limitations.

8. Quick Snapshot: Battery Swapping in China Trend Overview

| Feature | Status / Forecast |

|---|---|

| Swap station count | Nio: 3,000+; CATL: 1,000 in 2025 → 10,000 by 2028 |

| Vehicle servicing capacity | Aiming for one million vehicles per day |

| Heavy-duty trucks | 300 dedicated swap stations in construction |

| Geographic expansion | Primarily urban China; potential for dense markets abroad |

| Adoption drivers | Speed, convenience, policy support |

| Key challenges | Cost, standardization, logistics |

9. Real-World Impact: Adoption, Convenience, and Speed

Consider a ride-hailing driver in Shanghai: instead of waiting at a slow charger or paying a premium for fast charging, they pull into a swap station, exchange batteries, and resume work—losing minutes, not hours.

Contrast this with less developed EV markets, where limited charging infrastructure can lead to long delays or range anxiety. Battery swapping in China effectively eliminates that pain point.

10. Looking Ahead: Will Battery Swapping Have Global Traction?

- EV manufacturers might pilot swapping systems in cities where infrastructure gaps remain, especially in Asia or Latin America.

- Battery leasing models could reduce purchase cost, making EVs more attractive to budget-conscious consumers.

- Policy frameworks—including subsidies for swap station buildout—could catalyze adoption.

- Collaborative standards will be essential for cross-brand compatibility and scaling.

Conclusion

Battery swapping in China isn’t just a curiosity—it represents a bold leap in EV convenience, infrastructure, and user experience. As global EV markets confront infrastructure limitations, affordability concerns, and policy uncertainty, the lessons from China’s rapidly expanding swap networks are worth studying—and possibly adopting.

Battery swapping in China has the potential to:

- Drastically reduce refueling time.

- Bypass the need for home charging.

- Serve as a strategic complement to traditional charging.

- Bridge adoption gaps in dense or infrastructure-poor markets.

Whether the rest of the world follows depends on collaboration, investment, and will—but China’s lead today shines as a compelling model for tomorrow.

References

- Financial Times. (2025). CATL bets big on battery swapping with plans for 10,000 stations. Available at: https://www.ft.com (Accessed: 20 August 2025).

- Virta. (2025). Global electric vehicle market overview. Available at: https://www.virta.global (Accessed: 20 August 2025).

- The Guardian. (2025). Record number of EVs registered in western Europe across last quarter. Available at: https://www.theguardian.com (Accessed: 20 August 2025).